Corporate Banking

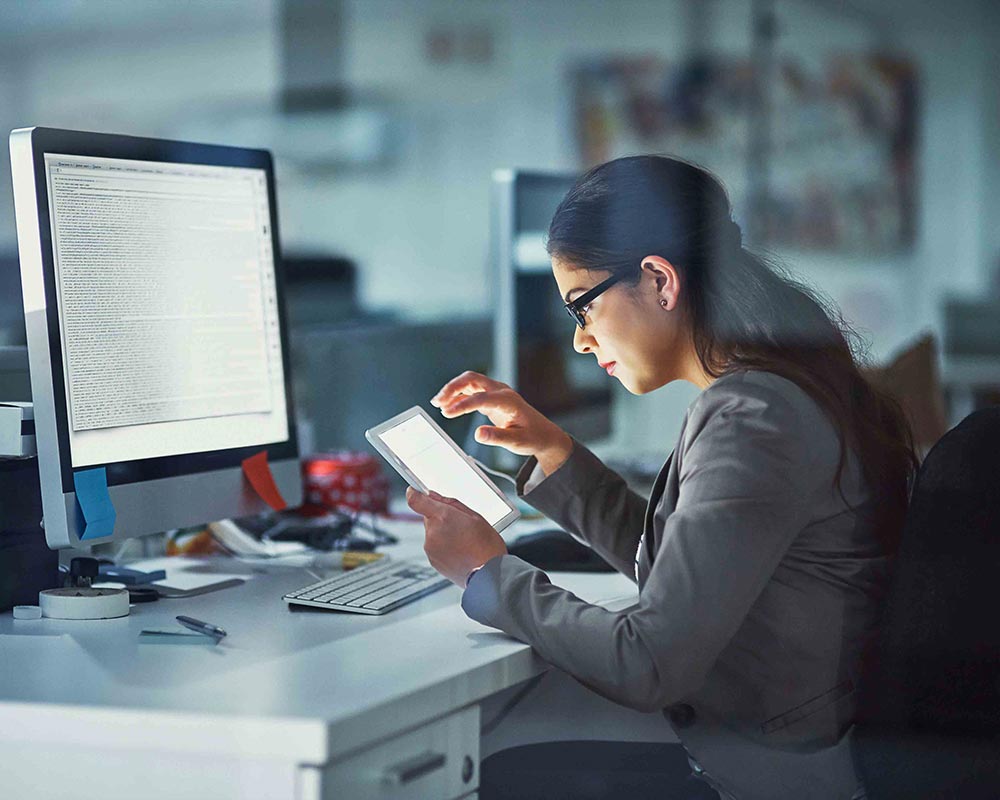

HSBC’s Corporate Banking services are an integral part of the Corporate, Investment Banking and Markets (CIBM) structure, with focus on offering an extensive range of services to multinationals, large domestic corporates and institutional customers.