- Article

- Innovation & Transformation

- Digital Adoption

Leveraging innovation, with speed and scale

India is home to the world’s second largest start-up ecosystem. It has revolutionised all the sectors of the economy not just in India but also globally.

With more young minds taking on the entrepreneurial role, it’s obvious that technology and innovation has played an essential role in growth, proliferation and disruption across the sector.

Today, successful startups grow along 2 dimensions:

For a business that’s set to grow at such a speed and scale, having a partner that’s agile and efficient is of equal importance. Today, a bank’s role goes beyond offering financial products, solutions and assistance to a business. It needs to don the hat of a ‘strategic partner’ on the business’s roadmap to growth.

HSBC has been a pioneer in this space with numerous cases across the globe. Our extensive global network coupled with our banking and financial capabilities has proved our ability of taking on the role of a ‘partner in growth’.

Here, let’s get a deeper look at a few case studies to understand how we matched the speed and scale of some innovative startups and proved to be a partner in their journey.

REAL BANKING, FOR VIRTUAL SYSTEMS.

MobilizAR Technologies Private Limited (Brand name: Playshifu)

A business with presence across geographies needs to address nuances of various regions. In such a scenario, a global bank such as HSBC is well-positioned to play a significant role in helping them navigate. That was the case with our client Playshifu).

Playshifu,based in India with a subsidiary in USA, specialises in designing and developing augmented reality-based educational toys for children. They were tackling requirements on 2 fronts:

- India (domestic): Meeting all regulatory needs related to funding

- International: Inability to be physically present for banking-related processes in USA at their USA-based bank

The client was also asked to maintain a USA contact number, proving this to be a costly and time-consuming operational task for a business based out of India.

HSBC’s global presence helped find holistic solutions for these issues. Domestically, the bank offered guidance by handholding the client through all the regulatory requirements in a timely manner. As funding is one of the lifelines of a start-up, HSBC was proud to have played a part in this leg of our client’s journey. Our approach led to a smooth capital raise, and Series A funding of INR 400 million was routed through HSBC seamlessly.

On the international front, HSBC routed the transaction through International

Business Banking (IBB) platform, wherein Playshifu wasn’t required to be present or submit any physical documentation in the USA. What topped this was the ability to open and operate their USA account within 3 working days, while still being in India.

To further simplify banking, considering the domestic as well as international transactions and banking requirement, HSBC helped set up the HSBCnet solution for them. It offers a single platform for transactions across all accounts in various currencies, anytime, anywhere. Our Corporate Credit Cards solution helped them manage operational needs efficiently. These services bundled together helped HSBC act as a truly strategic partner for Playshifu.

STAYING GROUNDED. WHILE LOOKING BEYOND THE HORIZON.

For a firm, scaling can be done across 2 dimensions – Products and Regions. For the latter dimension, startups expect expert guidance from a partner with a deep understanding of the international space. HSBC is proud to present 2 such cases in this space.

CleverTap

A leading user retention & engagement platform for consumer brands, CleverTap was founded in 2013 and is now one of the faster-growing mobile marketing automation companies, catering to over 8,000 apps including Fortune 500 brands.

For a firm of such size and scale, enabling seamless international operations is critical. CleverTap was looking to streamline its banking operations across multiple geographies, including India, Singapore and USA – which proved to be a tough task considering the multiple locally-focused banks.

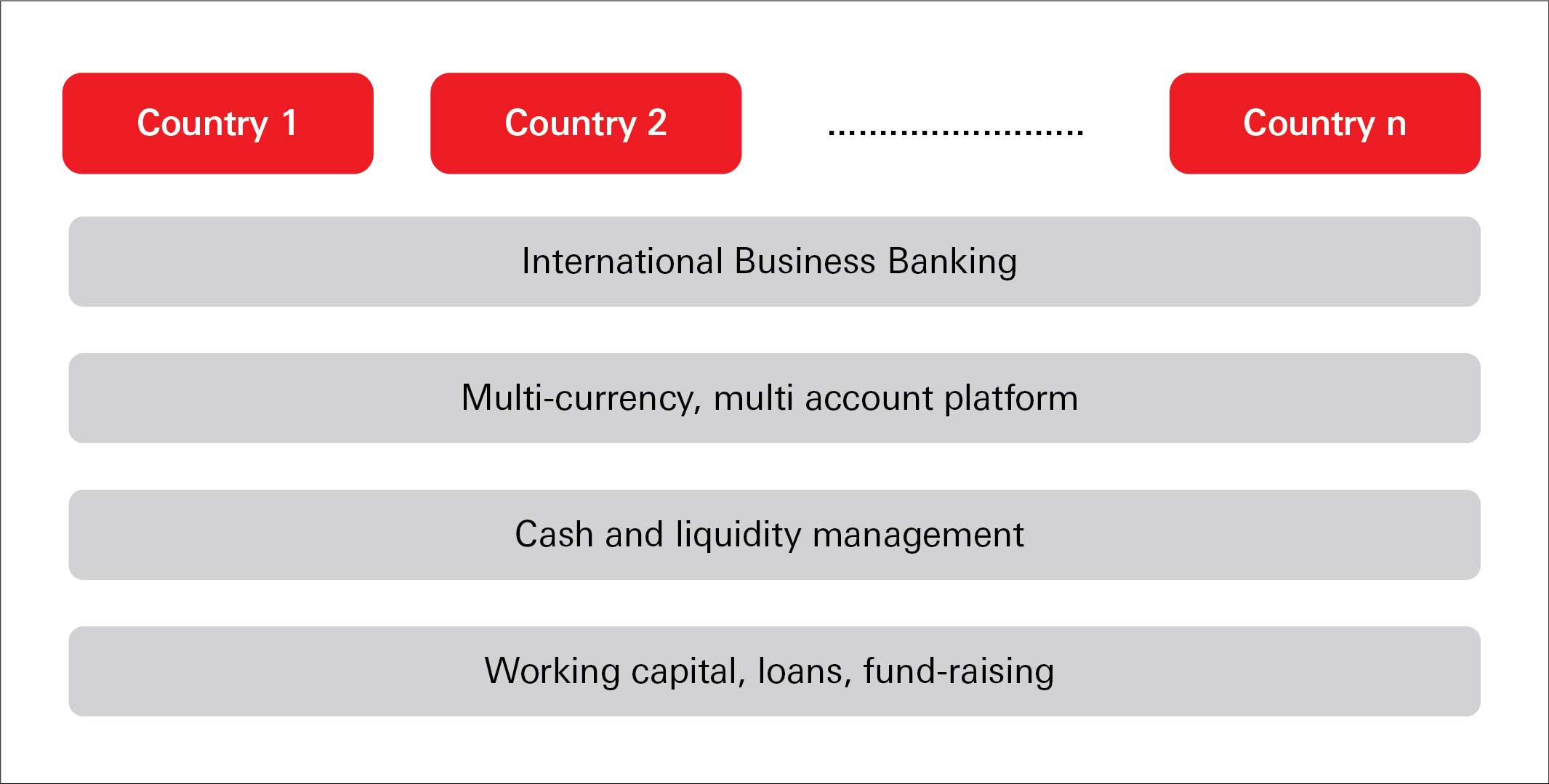

HSBC’s international network and strong understanding of the local SME ecosystems helped to provide a single platform to operate their accounts across multiple countries. The inherent cash and liquidity management features benefitted them to operate and access accounts efficiently. Going an extra mile, HSBC also offered working capital finance through Corporate Cards. Result? CleverTap now works with just one bank for all their operations across the globe without having to go to multiple local banks. As they gear up to expand to other regions, HSBC is already prepared to take on the role of ‘One Bank’ and provide all the necessary support to CleverTap to scale new milestones anywhere in the world, seamlessly.

KEEPING AN EYE ON THE FUTURE.

Robotic Wares Private Limited [FarEye]

While we take understand and analyse how technology has affected the way we work, Software as a Service (SaaS) has truly revolutionised the way we do business. One of the key strengths of a SaaS platform is its ability to scale up quickly.

FarEye, one such SaaS provider, is disrupting the age-old logistics business through this model, by helping more than 150 firms across countries with predictive logistics platform and ensuring optimisation of logistics operations.

The client was on the verge of drawing down the raised money from investors for business expansion. It comes with its own complications – FX pricing, KYC, regulatory requirements among many others. The key is to get all of them right, in a timely manner, and be on the right side of the law. HSBC worked closely with them to meet all the above requirements, leading to the organisation in closing the funding round smoothly. We further offered flexibility to them in handling the Nostro funds.

THE ROAD AHEAD

While there are many more examples to discuss, the crux is that banking is changing. We no longer live in a world where a business needs to work with multiple local and domestic bankers for everyday operations. A global bank, such as HSBC, is able to help the firms move up the ladder by through multiple offerings, irrespective of where they are from and where they are going.

To summarise, the HSBC proposition is a mix of verticals, country-specific solutions and horizontal, region agnostic solutions, such as:

Digitisation is blurring the borders. Startups now expect banks to continue to raise the bar when uninterrupted banking is concerned. The current challenging scenario has further accelerated and highlighted this need. HSBC is proud to play the part of a strategic partner and businesses launch innovative products rapidly and scale efficiently across regions.

Let’s innovate and grow together!

With inputs from Shekhar Lele and Anuj Kanwar

This article is part of 'Spotlight' - a series of articles where HSBC India leadership share their views on emerging trends, new technologies, business opportunities and more.