- Article

- Growing my Business

- Enable Growth

Our Customers Our Ambassadors

Article

There is no greater testimony of our services than positive customer feedback, and it is our constant endeavour to provide excellent service and product suites to our customers, so that they can be the ambassadors of our service excellence. We have seen several instances of great collaboration with our customers and also received appreciation from them for extending beyond the routine services.

“Our Customers Our Ambassadors” is a campaign where we will share stories about some of our clients and how HSBC India Business Banking was able to support them in their growth journey.

We live in a world of products. To explore we have ‘Google’, to socialize there’s ‘Facebook’, ‘Twitter’ is to microblog, ‘LinkedIn’ for networking and so on and so forth. All these online products, however, can be best experienced only if one possesses a high-quality physical device. If the device, in addition to being cutting-edge, also happens to be an industry leader in terms of product design and premium style, it is bound to achieve cult status. And what product comes to mind when we hear terms such as- “Rich experience”, “High quality”, Cutting-edge technology”, “Superior product design”, “Premium style”. You guessed it right, Apple.

Now, when you have a brand like Apple that’s built around customer experience, it only makes sense that their servicing would be best-in-class too. After all, the cult status isn’t just the outcome of the features on a new device but the overall support during its entire life cycle.

For the past 20 years, our client Maple has ensured and demonstrated how a leading brand delivers the promise of a world class servicing experience!

Manil becomes Maple

Circa 2005, in his journey of learning various facets of modern tech, Manil noticed the gap between servicing and sales and started exploring ways to plug it. Interestingly, looking at his flair for servicing Apple products, his colleagues at the time had already given him the moniker ‘Maple’ (abbr. for Manil is made for Apple).

And that’s how Maple was born.

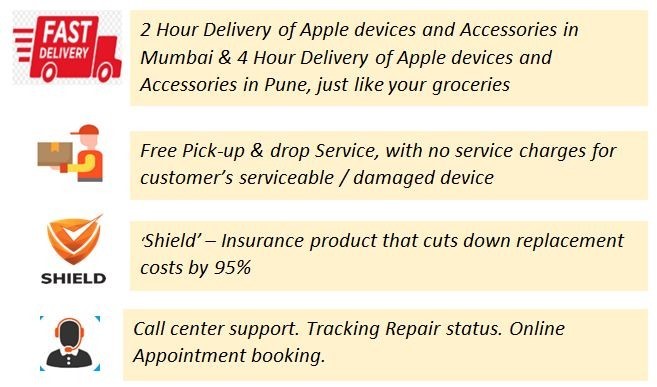

Maple, since its inception, has always aimed to revolutionize servicing standards to ensure that the customer experience stays intact throughout the product’s life-cycle. Some notable examples include –

Present is Good. Let’s build a better Future!

The vision at Maple is to become a one-stop servicing shop for all your smart devices. Unifying technology to make lives more efficient and meaningful is the goal at Maple. Keeping this vision in mind, CA. Ripul Gouri (Director Finance, Maple) started looking out for a banking partner with similar servicing ethos and a shared vision when it came to technology. That’s how HSBC & Maple crossed paths and embarked on a journey together.

HSBC installed their UPI systems for collections at Maple’s retail outlets, which rid their store staff of manual reconciliation after every transaction.

For online sales collections, HSBC provided their well-established APIs to ensure seamless flows.

For their expenses, Maple enjoys a generous unsecured credit line with HSBC at best-in-class rates, in order to be able to conduct their day-to-day business activities.

Says Mr. Manil Shetty, “We, at Maple, have high standards for servicing as our core principle. It includes - understanding customers’ needs and exceeding expectations in terms of delivery. With HSBC, we have a partner that’s trying to bring in innovations in real-time to enable their customers achieve their ambitions in the most efficient manner. This common bond of customer-centricity between us makes this relationship stand out. “

Mr. Gouri adds, “In all our partnerships, we look for 2 major traits – Quality & Love for technology. And under both these heads, HSBC fits the bill perfectly. In our day-to-day interactions with their team, we see a novel approach towards problem solving that’s aligned with Maple’s ideology. We thank HSBC for their support and are excited to be partners in this journey.”

Says Prakash Jaiswal, Country Head, Business Banking (SME and Start-ups), “From the perspective of building the country’s future, technology-based clients are really close to our hearts. Maple, with their digital focus, is one such special gem in our chest. I appreciate their innovative approach and high regard for customer satisfaction. Their dedication also motivates us to go beyond our limits to be better service providers. I’m positive our mutual out-of-the-box mindset to solve customers’ problems will help this relationship flourish in the times to come.”

The world, as we see and understand, is rapidly changing and SMEs now have a massive unexplored runway. HSBC’s technological infrastructure is well placed to support tech savvy customer-centric businesses. We are keen to offer you tailored solutions aligned with an ever-evolving digital ecosystem to achieve all your ambitions.

According to estimates, ∼75m students prepare for various government jobs in India each year with no supporting infrastructure. Owing to the massive scale and diverse aspirants' profiles, operating without a technological support is a major challenge. That is where our client Pariksha comes in to the picture, with their best in class technological platform to enable an uninterrupted flow of knowledge. They have been a key player in this space for over 5 years and have solved the penetration puzzle for the 'next billion users' customer segment by collaborating with top study centers across the nation.

EdTech for Bharat, and much more…

While there are reputed coaching centers to help students get through these highly competitive state government exams, the present model is predominantly offline, creating both physical and financial barriers for the aspirants. Pariksha is an EdTech platform that helps aspirants prepare for various government exams under the expert guidance of the most credible Institutes in each exam category, in the language of their preference. In their mission to make exam preparation affordable & accessible for Bharat, they have built their business model along 2 two broad themes: —

- Vernacular content (in 9 different languages currently)

- Credible and quality content delivery and engagement on handheld devices

In addition to their core area of government exam preparation, Pariksha has also ventured into life-skill coaching such as 'Language to English' programs to help people learn English faster. With plans around training in other skillsets such as MS Office, and digital marketing, Pariksha is on the path to bring a transformation in the life of millions of people.

Their 'freemium' model has gained a lot of traction with students and investors alike. With almost 5M users already signed up and government jobs starting to open up after a year, the business expects to grow at a much faster pace than the expected forecast. To fuel and sustain their momentum, Pariksha opted for HSBC as their banking partner.

Bank with a Start-up focus

A lot of transactions flow through Pariksha systems – payments from customers across India and payments made to coaching partners. They needed a banking partner with excellent digital capabilities and support. They have been using HSBCNet, HSBC's best–in–class digital platform, to manage the accounts seamlessly. They are also using HSBC corporate cards for making digital payments. The digital tools are coupled with support from HSBC's dedicated start-up banking team to address all banking and regulatory queries swiftly.

Vikram (Founder, Pariksha) says, "We are basically operating in a blue ocean space, and so we needed a banking partner with a strong start-up focus to cater to the ever evolving needs of the business. HSBC is among the few banks with dedicated start-up teams and they have always gone above and beyond to fulfil our demands. With start-up friendly digital tools and processes, HSBC has been our true partner and we look forward to continue our relationship with them"

Prakash Jaiswal, Country Head, Business Banking (MSME and start-ups), adds, "Covid-19 pandemic has taught us that education is going to get revolutionized by technology and Pariksha certainly has a strong first movers' advantage in the space. We are as excited and optimistic as them to embark upon this journey and would continue to support them with innovative services through our Beyond Banking initiative and digital channels"

As far as transformation of education through technology is concerned, it seems we have just scratched the surface. There is huge potential in our country and we expect a lot of start-ups to come up with innovative models in this space. We at HSBC are excited to be a part of your journey and help you achieve your goals.

We take many things for granted in our lives. One of them is 24X7 availability of water, the moment we turn on the tap. Have we wondered about the action that happens behind the scenes in manufacturing a ubiquitous tap and all other sanitaryware products? Let’s understand it a bit more, from our client Pearl Precision’s story.

A great strike rate so far…

Pearl Precision started its journey in 1986, as an OEM supplier to the TV industry. The association with large domestic and global consumer brands helped nurture Pearl Precision’s focus on new age technology and the end consumer’s needs since inception. In 2011, the company sensed a great opportunity in sanitary ware. The company pivoted, and started manufacturing various items like Cisterns, Seat Covers, Cabinets, P.T.M.T. Taps, Connection Pipes, Kitchen Sinks & Bathroom Accessories.

However, just like the early part of a typical innings in cricket, the initial few years were a struggle for Pearl Precision. It was primarily because unorganised players dominated the sanitaryware market in India with a market share of 60%. While Pearl’s products were superior, these competitors enjoyed a cost arbitrage of almost 28%.

However, good times were not far away. Demonetisation and introduction of GST paved way for more formalisation of the economy. The disadvantage of cost arbitrage vanished, and Pearl Precision grew rapidly. It is now a leading player in Tier 2-4 cities.

It has also pioneered manufacturing of plastic taps and pipes, which are much cheaper than existing varieties, yet don’t compromise on quality, and aesthetics.

To differentiate from competition, Pearl Precision puts a lot of emphasis on best in class sales management practices, and focusses on constant learning and self-development.

Aiming for more…

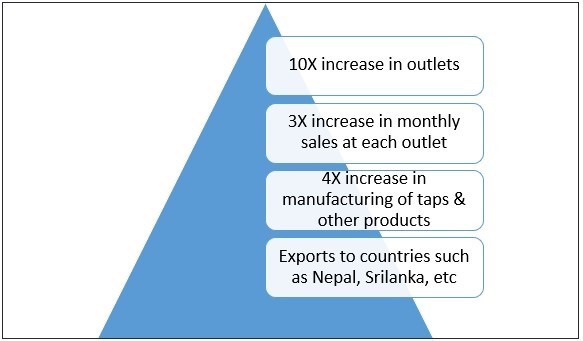

While things were progressing quite well, Pearl’s MD, Mr Naresh Kumar Garg realised that his products garner only a 1% market share. He felt that there is a huge potential to significantly ramp up this number, considering the company’s geographical presence and manufacturing prowess. With these thoughts, Mr. Garg and his company have chalked out an ambitious 2030 vision plan to increase the market share from 1% to 6%. Some of its levers are:

Good job needs money….

In order to achieve the 2030 vision, Pearl Precision decided to set up a new manufacturing unit in Noida. It approached HSBC for funding the project. HSBC understood Pearl Precision’s business model, how it differentiates itself from competition and provided the necessary funding to the new project at the right pricing. Apart from this transaction, Pearl Precision also started actively using HSBCNet, the bank’s one stop platform for global banking.

Says Mr Garg, ‘We had to move fast with the operationalisation of our new unit. HSBC acted as our true partner. All their loan approval processes were very smooth, and we could complete all formalities without the need to visit HSBC branch even once. We also perform payment transactions seamlessly. As we continue to expand and also build in digital capabilities along the way, we look forward to continue working with HSBC in the future’

Says Prakash Jaiswal, Country Head, Business Banking (MSME and start-ups), ‘There is a story of aspirations and dreams behind every rupee that we lend at HSBC. Pearl Precision’s story is indeed a very fascinating one. It tells us how Indian SMEs are conquering a market as fragmented as sanitary ware, through innovative use of technology and deep understanding of the consumer. We cherish our relationship with Pearl, and look forward to play a role in their growth over many more years’

SME lending is one the biggest focus areas in Indian financial services space. We at HSBC believe in creating a differentiation through a combination of digitisation, empathy, and a partner driven approach. We treat SMEs as emerging corporates while assessing credit worthiness. We are keen to understand your ambitions, and discuss how we can help you achieve your goals.

New age technologies have transformed multiple industries across the globe. However, to differentiate themselves from competition and extract the most out of technology, businesses often need expert guidance on the choice of technology, design and the approach. This is where our client EVOTEK has been playing a pioneering role for the last 8 years.

What’s EVOTEK all about?

EVOTEK, Inc. is headquartered in San Diego, USA. It is a premier enabler of digital business with a focus on innovation. With technology offerings spanning across multiple spheres such as cybersecurity, mobility, communication platform, intelligent automation, cloud and executive advisory, EVOTEK is uniquely equipped to enable customers with the industry shift from traditional IT computing to secure multi-cloud.

The India connection, and role of HSBC

In order to better tap growing opportunities in digital India, EVOTEK setup an office at Delhi in 2020.

While the need for cutting edge technologies is common across the world, local nuances vary. On one hand, EVOTEK had to manage transactions with its parent headquartered in USA and on the other hand ensure compliance to all Indian laws and regulations. To add, EVOTEK had to work with local vendors to source technology and networking components for their Indian clients. For a USA based firm with nascent presence in India, this was a significant challenge. Hence EVOTEK needed a partner who is global in nature, yet an expert in Indian laws. This is where HSBC, with 150 years of presence in India proved to be a perfect match.

To on-board EVOTEK in India and complete KYC, HSBC leveraged its own presence in USA to minimise the friction in the process. HSBC trained the EVOTEK team on digital solutions and India specific processes related to low cost transactions, cross border remittances and RBI compliance.

On a specific occasion where EVOTEK had to complete a supply of servers to one of its Indian customers, it needed a credit line on a priority basis, to pay off custom duty charges levied against import of servers. HSBC acknowledged a standby letter of credit (SBLC) issued by EVOTEK’s USA based bank and completed the transaction digitally within 7 days. All loan documents were signed digitally using HSBC Intellisign to avoid any physical visits. This swift response coupled with digital solutions in turn helped EVOTEK meet its client’s demands.

Says Mari Rodish, CFO, at EVOTEK, ‘HSBC has been a valued partner in our global operations. It is uniquely positioned to understand the global nature of our business, yet help us in plethora of compliance and guidelines across individual local markets. Their simple to use digital solutions further help us in managing businesses better. Along with India, we work with HSBC in Singapore and Taiwan as well. We look forward to a long relationship with HSBC as we expand globally’

Says Prakash Jaiswal, Country Head, Business Banking (MSME and start-ups), ‘Technology has provided to be a game changer across industries globally. We have always supported the digital transformation by partnering with innovative technology firms such as EVOTEK. There are however multiple moving parts in doing business across countries. We want to abstract all these nuances away from our clients, so that they can focus on their core operations’

If your global firm is keen to expand in India, we would be happy to partner with you to help you navigate all complexities, and make it big. We have an international business banking proposition that will help you easily setup local offices in other countries as well.

All of us realised the true value of this age old proverb during the pandemic. While we seem to have found a way to fight the immediate crisis, we are still far away from calling ourselves a healthy nation. As per global healthcare access and quality index, India ranks as low as 145th among 195 countries. Clearly there is huge scope for improvement. Of late, numerous start-ups are trying to improve the quality of life, through technology. One such HealthTech firm is our client iKure Techsoft Pvt. Ltd, who has been performing pioneering work for more than 10 years.

Delivering phygital services, from India’s remotest villages to the offshores

iKure is a social enterprise that delivers primary healthcare, wellness and prevention services to communities in India. iKure’s healthcare model has acquired extensive support and recognition across the world for being innovative, technologically advanced and sustainable.

iKure caters to primary healthcare across rural, semi urban & urban population. It realised very early that given the geography and demographics of its target segment, a standalone physical or digital approach will not help deliver services at scale. Hence it adopted a 3-pronged approach:

- Network of Hub and Spoke clinics

- Mobile frontline health workers

- Teleservices over Smartphone

Through this approach, iKure has been able to scale up rapidly and serve remote places in India.

Moreover, iKure’s research programs serve as a source to improve treatment efficacy, operational efficiency and user satisfaction using real-time data. They leverage AI and Machine learning algorithms to create not only health, but also societal and economic impact. iKure is working with several international research partners to ensure every Indian receives safe and secure digital health services. It is also serving the needy in countries such as Vietnam and those in the MENA region.

Work during the pandemic

During the crisis, iKure provided remote monitoring services, early screening tests to break the chain, vaccination drive to manage demand of hospital beds and oxygen support. It facilitated a common platform that brought the local self-help groups, NGOs, healthcare providers to support rural villages. It’s efforts garnered appreciation from the United Nations and World Economic forum where iKure was recognised as one of India’s top 50 covid-19 last mile Responders to the pandemic.

Global bank for Phygital services

iKure’s noble work spans boundaries, from serving patients in remote parts of the country to international markets. It had diverse banking needs. On one hand, it needs a bank that can help it manage payments and collections in India’s rural areas better. On the other hand, it expects the bank to help manage its businesses across countries. And iKure found a suitable partner in HSBC. For India, iKure and HSBC are working together to offer UPI solutions to end customers, and manage collections over virtual accounts. For global operations, iKure actively uses HSBCnet global internet banking platform. It helps iKure manage its cross border inward and outward flow seamlessly.

Says Sujay Santra, Founder and CEO, iKure, ‘We are trying to bring a positive change in the society by deploying innovative means and technologies in healthcare. We needed a banking partner who can serve all our needs and help us in scaling up. HSBC fits in beautifully in our journey. We are pleased with its support and digital solutions so far, and look forward to continuing our association with HSBC.’

Says Prakash Jaiswal, Country Head, Business Banking (MSME and start-ups), ‘HealthTech has a huge potential to transform our country’s health infrastructure. iKure is doing stellar work and HSBC is proud to be associated with iKure’s journey. We will continue to offer innovative domestic and global solutions in areas such as payments, remittances, financing, managing of capital flows, among others to help innovative companies such as iKure scale rapidly.’

India is witnessing a massive transformation in multiple sectors, thanks to application of new age technology and surge in digital adoption. HSBC is deeply embedded in the new age ecosystem. We are keen to engage with you to understand your local and international banking needs and serve you better.

“If I had asked my customers what they wanted, they would have said a faster horse.”

While the attribution authenticity of the above quote to Henry Ford is still debated, it continues to resonate with inventors and change makers for a simple reason – Vision.

Visionary people have a way of seeing opportunities where common folks see crisis. This thought process has been the major motivation behind all inventions and advances and continues to be the guiding force of humanity. Using Peter Thiel’s famous terminology, all 0-1 companies possess this ‘Out of the box’ thinking approach when it comes to solving world problems. Our customer Simple Energy is among one such rare group of trailblazers who are revolutionizing the Indian automobile segment since their entry in the coveted EV segment in 2019.

Made in India, by Indians, for the World:

As the story goes, Suhas (CEO & Founder, Simple Energy), an automobile enthusiast himself, was looking to buy an EV scooter for his family in 2018. He was shocked to find that despite all the buzz in the western markets, India still didn’t have anything that would satisfy the traditional buyers’ needs. That is when he, along with his co-founders Shreshth and Ankit decided to build one, tailored for Indian sensibilities, at par with international standards.

The team had the good fortune of receiving support from Manish Bharti (Chief Revenue Officer, CoreStack) and Raghunath Subramanian (Non- Executive Chairman UiPath India, Board Director 1Digi investment Management) , who backed these young guns with one of the biggest Pre Series rounds in the industry.

Their model (ONE) is a result of a focused approach and experienced mentorship. It aptly addresses three primary concerns with Electric vehicles– range anxiety, charging time and affordability. ONE is expected to have a range of 200+ km, with a charging time of 75 minutes and is smartly priced to provide complete value for money. This made-in-India scooter was launched in style on 15th August, as a statement from a new and bold India, to free the world of the growing carbon footprint concerns.

Going through the trials and tribulations in their own journey, the Simple Energy team quickly realized the need of an ecosystem in the nascent Indian EV segment. Their future projects involve collaborating with competitors on multiple fronts to further the sector, as a whole. The Loop network, which provides charging on the go, came out of this ‘Common Good’ philosophy.

A bank that understands:

To support their innovative and aspirational journey, Simple Energy needed a banking partner that understands their long-term vision and they found a perfect fit in HSBC. In a R&D intensive business like this, capital requirement can be intermittent. A company may require huge amounts at one go in one cycle, while there could be long durations with limited need. To ensure instant access in need and capital appreciation in idle months, HSBC extended their wealth management services to support SE’s growth. Regulatory requirements associated with fund raising, being the bank’s core competency, were managed in a way that the visionaries were able to focus on what they do best. HSBC has already on-boarded Simple Energy on HSBCNet, our digital platform, to ensure seamless payments and collections once the sales begin in March’22.

Founders' and investors' appreciation motivates us to push more...

Says Suhas, “We needed a banking relationship to take care of our capital needs in a way that matches our working style – Bold, Innovative & Personalised. HSBC has just been that partner for us. We feel confident in their services and are convinced that as the business grows we would always be able to bank on their expertise and focus to support our vision.”

Shreshth & Ankit agree, “HSBC has provided what today’s start-ups need the most – a modern seamless platform, reliable pathway and a consumer-centric banking relationship”

From the Investors desk:

Says Manish, “I feel honoured to be part of SE's phenomenal journey. These guys have beaten my expectations, and we are all excited for the product to hit the roads. I would like to highlight the proactive approach of the HSBC team who are always available for support. Their capabilities in managing capital account transactions, from booking forex rates through to the final documentation, is simply state of the art”

Raghu agrees “With the launch of ONE, the world shall see Indian roads turn into the sets of a Sci-Fi. They have been working with HSBC for our investments. Among other services, HSBC's compliance handling of our capital account has been top-notch.”

Says Prakash Jaiswal, Country Head, Business Banking (MSME and Start-ups), “Electric vehicles are the future and Simple Energy, by extension, is a window to the glorious times ahead. Their thought process will usher in a new age of Indian products for the world. We look forward to this collaboration and hope to achieve many more milestones in the times to come.”

At HSBC, we are committed to helping businesses transition to a more sustainable future, which means unlocking finance and going beyond. We are open to extend our services and support to all the change makers out there to realize their aspirations.

International Banking - A child’s play

The previous decade can rightfully be called as the decade of start-ups. Many folks took the plunge and started something close to their hearts, thanks to an entrepreneur-friendly ecosystem and accompanying technological advancements. Shumee Toys Private Limited, a brainchild of founder Meeta Sharma Gupta, was one such start-up.

What is Shumee all about?

Before venturing into the world of business, Meeta was a researcher with IBM TJ Watson, USA. Her research primarily focused on computer architecture and systems design. She has a PhD from Harvard University, MS from University of Southern California and BTech from IIT Delhi.

Meeta observed the development in her kids thanks to toys. This inspired her to explore the space of 'play and develop through toys'. The art and craft of designing toys was a step into the unknown, but she wanted to create something to let a child explore and grow naturally.

Eventually, Shumee was born on 22nd January 2014. They are a Bangalore based start-up, manufacturing eco-friendly and educational wooden toys. In this age of information technology, Shumee strives to create innovative learning toys that provide kids much needed break from digital screens. Their designs are focused on natural and age-appropriate play for the child’s development in a sustainable manner.

Shumee sells the products though their own website and other e-commerce sites in India, US, and UAE. They also supply products to other firms focused on the children’s space. They have plans to expand to the UK and European countries.

A much smoother ride with HSBC

HSBC’s multi geography presence helped Shumee’s banking requirements. It started right from the step of opening an account with HSBC USA. Everything was managed remotely through smooth co-ordination between HSBC India and USA teams. The account with HSBC USA was opened in under 3 days without the team having to visit USA in person! They were able to view all the details of Indian and USA accounts on a one single integrated platform – HSBCNet. This made banking operations much smoother.

The real benefit, however, was in cross border transactions. Receiving inward remittances from customers in other countries became hassle-free and they had a better visibility of the inward transactions. They were in receipt of FIRCs in timely manner, and could meet the regulatory filing deadlines.

The way ahead

Riding on the successful engagement, Shumee has been looking to use other HSBC products as well.

Says Meeta,“We started our journey with HSBC in 2019 and it has been a good relationship with the bank. We got good support from the bank for our business needs, starting with the help in handling our foreign remittances and also opening corporate credit card. We find the team quite approachable and also helpful in solving any issue we may face or any solution we need from the bank. The team also takes care of necessary paperwork in the most seamless manner. Overall a very happy experience with HSBC. As we enhance our product lines and international presence, I am sure the relationship will grow further. Overseas banking operations which are perceived to be complex, have become child’s play for our children’s toy manufacturing start-up!”

From HSBC’s perspective, it has been a pleasure to work with Meeta and her team at Shumee, and see her grow from strength to strength. We believe firms like Shumee should spend minimum possible time on banking – be it domestic or international. HSBC offers simple and agile banking by providing clients with all the digital tools required to manage their banking operations. We are continuously strengthening our offerings – be it payments, collections, trade finance, and many others. The future looks exciting and we are geared up to support our clients’ aspirations.

Just like Shumee, many other start-ups and D2C companies have been offering various innovative products to consumers. As the start-ups spread their wings, they need a strong banking partner to eliminate the hassles behind the scenes. By offering best-in-class services and products, HSBC strives to be their partner in growth.

Fostering funding for food

There is one ageless debate in India: Vegetarianism v/s non-vegetarianism. While everyone is entitled to their own view, reports show that interest in veganism is on the rise. One individual - Siddharth Ramasubramanian made it his mission to address the glaring nutrition gap in India. His belief that discovering great food brings people together led to founding of the start-up Vegolution in 2019.

What is Vegolution all about?

India has the highest number of vegetarians in the world. According to Siddharth, a fairly large number of vegetarians in India struggle to find sufficient variety in their daily diet which combines taste along with essential proteins and vitamins required to meet their nutritional needs.

Vegolution is addressing this gap by introducing protein-rich ready-to-cook products for the modern Indian. They launched their products under the brand name ‘Hello Tempayy’ which offers a new, versatile and nutritious new ingredient, Tempayy. It comes in 4 flavours which are gut-friendly, dairy free and gluten free. Their innovative food when paired with Indian cooking methods offers consumers a new food choice that is wholesome and nutritious without compromising the taste-buds. Vegolution supplies to e-commerce platforms and is currently available in Bangalore.

Good food needs money...

Unlike vegetables, money needed to make vegetarian food doesn’t grow on trees. Vegolution required money to expand. In 2020, it had planned to raise $1 million from overseas investors. The fund raise was facilitated through 16 inward remittance transactions. Receiving foreign inward remittances (FDI) under strict regulatory guidelines requires well designed planning and understanding of foreign exchange fluctuation risk. Vegolution turned to HSBC for their expertise, and HSBC became their first major banking partner. HSBC played a pivotal role in streamlining the fund raising for Vegolution. A few of the activities included:- Providing competitive USD-INR conversion rate, thanks to HSBC’s global presence.

- Issuing Foreign Inward Remittance Certificate (FIRC): RBI mandates that a firm receiving foreign funds needs to submit FIRC within 90 days. HSBC issued the FIRC within 3 days thereby making the process of meeting the regulatory requirement very smooth.

- Foreign Currency- Gross Provisional Return (FCGPR): Every company receiving foreign investment (FDI), is required to do the necessary reporting to RBI. HSBC worked with Vegolution’s auditors to ensure all the necessary compliance in the fund raise was met within timelines.

As a result of all these activities performed behind the scenes, Vegolution was able to concentrate on its core business operations without any hassles.

Food for thought for the future

Vegolution has been using HSBCnet, a one stop shop for all internet banking needs.

Says Siddharth, ‘It has been great to work with HSBC for all our banking needs. Riding on the successful engagement, we are now looking to make use of other HSBC products such as Omni channel to offer payment gateway for all of our customers, and HSBC corporate credit cards, to further streamline our operations’

HSBC India has a keen focus on supporting the start-up segment. Growing interest in vegetarian food, fueled partly by changing lifestyle trends and demand for nutritious food are some of the growth drivers for start-ups like Vegolution. They offer innovative products to meet growing demands of the society. Their expectations from their banking partner include a detailed understanding of their set-up and unique financial requirements. For us at HSBC India, it is about going much beyond traditional products such as deposits and loans, and meeting multiple needs that start-ups of today are demanding from us. Exciting opportunities exist in facilitating seamless international banking, FDI flow, offering innovative payment and collection products, among many others.

MaxWholesale - Unchaining India’s Supply Chain

Home to more than 1.3 Billion people – about 350 Million homes – India lives in its lakhs of neighbourhoods spread across thousands of kilometres across the length and breadth of the country. Second largest population globally, the largest democracy in the world, India consumes more than $650 billion worth of food and grocery on an annual basis which is more than 65% of its retail economy.

What is really mind boggling about India’s food and grocery market is that it is largely a sachet-ized economy, where most products are sold in extremely small quantity packs – such as biscuits for INR 5, chips for INR 10, even ghee and oil sachets for INR 20. Distributing these products across such a vast nation is no child’s play. It’s a huge market with billions of micro transactions, with products and money changing hands.

Solving this problem of matching supply with demand is Delhi based MaxWholesale, a client of HSBC for last 3 years.

How it all started…

MaxWholesale was founded by Samarth Agrawal and Rohit Narang in the summer of 2016. Samarth is a computer science graduate from IIT Delhi and a finance major from Columbia University, New York. Rohit has completed MBA from Symbiosis Pune, and used to run a modern Kirana store in Hauz Khas, South Delhi for 18 years. As neighbours, the duo used to meet often and discuss latest developments in the world of retail and technology, with a vision to build something together. They realized the problems faced by kirana stores to procure goods from an antiquated supply chain, which had not changed with the times.

Problems a-plenty for Kirana stores

As Samarth rightly said, a Kirana shop is the first to switch on the lights and last to switch off the lights in any street of India. A traditional Kirana store owner works for roughly 14 hours a day, and earns a net of approx. 25 paise for every INR 10 product sold.

Daily, the store owner faces problems in 2 broad areas:

- Broken procurement: Out of the total food and grocery consumed, approx. 50% is controlled by Wholesalers.

Procuring from these wholesalers is full of issues, such as –

- Limited variety offered

- Uncertainty in quality of goods delivered vis-a-vis promise

- Uncertainty in time of delivery

- Negligible use of technology

- Heavy reliance on cash payments

- Banking: A Kirana store is generally operated by a single person. Any visit to a bank branch even for a few minutes results in a direct loss of sales.

All these issues add to the woes of the kirana store owner every single day.

How to change things?

Samarth and the team at 99 algorithms asked themselves one question- ‘How can we make the life of a Kirana store owner better?’

99 algorithms started step by step to solve Kirana stores’ transaction and banking related issues. They put technology first, and came up with an end-to-end proposition:

- The purpose – Why?

- Make kirana owners achieve more with the same time, space and money - Objectives – What?

- Offer large selection of items from mobile app

- Provide dependable and predictable supply

- Assist in logistics and inventory management - Solution – How?

- One stop mobile app for all purchases

- Guarantee delivery within 24 hours

- Embedded MaxPay to digitise all payments

With a mobile app ‘Maxwholesale’, 99 algorithms call themselves ‘Warehouse in the cloud’. They want the kirana store owner to spend maximum time on the business, while they handle the rest. It helps to breakdown the distribution barriers between the FMCG distributor and the last mile Kirana store. The team has already managed to reduce pain for more than 30,000 kirana stores across NCR and Chandigarh so far, and the journey continues

Acceleration during the pandemic

While the pandemic period has been disruptive, 99algorithms turned it into an opportunity to serve the kirana stores even better. 99algorithms plan to build on all the good work, and have a pan-India presence in the future. With an eye on offering credit lines to kirana shops, future looks even more exciting for Samarth and his team.

How HSBC played a part

99 algorithms has been banking with HSBC for more than 3years. The relationship is primarily driven on 2 fronts:

- 99 algorithm’s own banking needs

- Last year, 99 algorithms raised Series A round of funding. In order to enable this, there are lot of activities that need to fall in place behind the scenes – favourable USD- INR rate, quick remittance into Indian bank account, quick issuance of Foreign Inward Remittance Certificate (FIRC) as per RBI guidelines, to name a few. HSBC, being a global bank, specialises in such transactions, and ensured that 99algorithm’s fund raise was a smooth affair

- Samarth’s team is a regular user of HSBC’s one stop digital solution to facilitate vendor payments, payroll management and managing multiple banking accounts in a single view.

- Service to our customer’s customers – Kirana stores

In order to provide a seamless experience to Kirana store owners, it was critical for 99 algorithms to shape their behaviour. A key activity was to embed all payments seamlessly within the main app, so that the person can perform all activities viz. search for products, order and pay through a single interface.

A key payment mode is UPI. 99 algorithm’s payments team MaxPe worked with HSBC’s UPI team to integrate UPI sdk within the app. With this solution, the entire UPI experience was embedded deeply in the MaxWholesale’s App. The app is now a combo of order management and payment service provider.

A larger purpose together

It is a big challenge that 99algorithms have set for themselves.

Says Samarth – ‘Our motto is to help Kirana stores manage everything end to end as effortlessly as we as individuals can. HSBC has made our banking smooth, trackable and dependable. The deep integration with UPI in partnership with NPCI has been a game changer. It helps retailers complete all transactions at one place and eliminates all reconciliation hassles’

Says Prakash Jaiswal, Country Head, Business Banking (MSME, Start-ups), HSBC India, 'For HSBC, our customer’s customers are our customers as well. We, as individual consumers depend a lot on the neighbourhood Kirana stores, but never realise the pain they undergo every day. Samarth and his team are doing a noble job of fixing problems in their lives. HSBC is proud to have played a part in their cause. We look forward to offering more digital solutions to Kirana store owners and a larger ecosystem in the country’Helping the world move

The pandemic has brought in major disruption globally. However, we have been able to consume all essential products and services such as electricity, water, milk, food, etc, without any interruption. Unknown to us, a countless number of behind-the-scenes activities are taking place 24x7 to make this happen. In fact, the entire infrastructure sector – be it road, rail, air, oil & gas, power, etc. – has been functioning non-stop irrespective of the situation to ensure we are not inconvenienced. In order to make the infrastructure work, hundreds of thousands of parts, weighing from a few grams to thousands of kilograms, need to be produced every day. This is exactly what our client Karmen International Pvt Ltd has been contributing towards, for last 20 years.

What is Karmen all about?

Karmen is a Tier 1 manufacturer of machine cast, forged and precision machined components. These are widely used in industries such as aerospace, defense, fluid handling, locomotive and rail, off highway, oil and gas and power. Karmen goes a step further, and delivers true manufacturing partnership with knowledge led services such as contract manufacturing, value added supply chain consolidation, and engineering support.

What differentiates Karmen from other manufacturers?

- Traditional manufacturing cycles extending into months are fast becoming obsolete. Modern infrastructure requires agile techniques with quick delivery, testing and iterations. Karmen understood this very early, and has been focusing on innovations such as Rapid Prototyping, On-demand manufacturing and bespoke manufacturing. As a result, Karmen has been able to bring in massive value to its clients through –

- Prototype delivery in lesser than 12 days

- Simplifying supply chain complexity

- Avoiding minimum order quantity

- Management of excess inventory - Generally, manufacturers focus on volume production of similar parts. Karmen has adopted a different approach. It believes in adding real value to its clients, by investing in Research & Development and engineering, and focusing on non-commoditised low volume components.

- Karmen is a Tier 1 supplier to more than 40 global corporations across USA, Canada, UK, Germany, Australia, India, Sweden, Slovenia, and Japan. Today 75% of Karmen’s revenues are from exports, which is evidence of its processes and products.

Karmen has thus been able to successfully position itself as a manufacturing partner for modern industrial and infrastructure needs.

However, availing finance was initially a bumpy ride

Karmen had been working with a few banks for financing. However, the entire process was far from perfect. Issues which Karmen faced were long drawn processes in due diligence, verification and disbursement of loans.

The root cause was that banks categorized Karmen as a typical SME and focused mostly on their size, quantity of output produced, and compared it with that of other manufacturers. Contrary to this, Karmen differentiates itself by focusing on low volume, high value, high integrity differentiated products and this business model has helped Karmen become a leading supplier. Unfortunately, the traditional mindset of credit assessment didn’t accord necessary consideration to this differentiation. It ended up creating challenges for Karmen’s team. They had to spend significant amount of time responding to a large checklist, typically found in traditional SME credit risk framework. This triggered a need for Karmen to have a different banking partner.

That's where HSBC came in and brought about a two-fold change

Karmen joined hands with HSBC over fifteen months back and HSBC positioned itself not just as a lender, but as a strategic partner for supporting growth. In fact, the engagement began much before the first rupee was agreed to be financed. HSBC’s processes of due diligence and background verification took into account all of Karmen’s strong capabilities and this benefited Karmen’s team.

Says Mr. Ramesh Venkatesan, CEO & MD, Karmen, ‘Even before we became their customer, HSBC India’s top leadership interacted with me. They understood our business model and strategy and how we differentiate ourselves from other suppliers. We were quite happy with their personal touch from the top. The entire process of financing was smooth. As a result, my team’s bandwidth was freed for doing our core business work’

Digitisation

Availing finance is followed by transaction processing. This is another area where Karmen witnessed a major change. Traditionally they relied on cheques for payments and collections. HSBC team encouraged them to move to digital channels, and also handheld them in transitioning from physical to digital. Today, Karmen uses HSBC’s multiple digital platforms such as HSBCNet and BulkPay for all online transactions, ITS for trade transactions, FX evolve – Forex Services, FX contract booking, and Hedging. During the pandemic, HSBCs innovative Digital Signature Solution helped Karmen to execute documentation in matter of few minutes.

Says Mr Ramesh ‘Earlier we used to resist shifting towards digital. HSBC changed our mindset. This shift helped us, especially during Covid period. HSBC has truly been our partner in our operations. We look forward to working with HSBC on multiple requirements in future’

Banking for manufacturing

Each SME manufacturing business is different. It is important for banks not to paint all firms with the same brush. Traditionally, manufacturing sector’s adoption of digital banking has been slow. It is bank’s responsibility to encourage the shift to digital. HSBC is proud to serve Karmen on both these fronts.

Says Prakash Jaiswal, Country Head, Business Banking (MSME, Start-ups), HSBC India, ‘Manufacturers such as Karmen are doing an incredible job in oiling economies across the world. We as banks have a role to play to help them grow, and bring in new approaches – be it financing or digitisation. We cherish our relationship with Karmen, and look forward to continue to partner with them to help meet their unique needs’

Empowering the future of hygiene

28th May is observed as ‘Menstrual Hygiene Day’. Once a taboo subject, women’s hygiene management is slowly gaining wider acceptance across the globe. However, the battle is far from over. Our country faces problems on two fronts –

- Almost 2 out of 3 women in India don’t have access to safe sanitary napkins

- Material disposal adds more than 12bn tonnes of waste in landfills in India, which will take more than 800 years to recycle.

Most of us are unaware of the quantum of these harsh realities. Neither was Ajinkya, a young mechanical engineer in his twenties, with a stable job. However, one incident in his life changed everything. It led him to start ‘PadCare Labs’ – a one stop platform for female hygiene and eco-friendly waste management.

We talk about how technology is transforming fields such as medicine, infrastructure, services, etc. However, PadCare is perhaps one of the most unique use cases of technology, as it aims to bring in a massive positive social and environmental impact simultaneously.

What is PadCare, and what makes it special?

PadCare is trying to meet three interlocking objectives, namely – Hygiene, Technology and Environment.

- Hygiene: The very first problems that PadCare wanted to solve were awareness and accessibility. They partner with companies, educational institutes, hostels, NGOs and many other institutions. They install bins in individual washroom cubicles where women can privately and safely dispose their used menstrual absorbents. The sensor-based touch-free bins help women dispose their menstrual waste separately from general waste. This reduces chances of infections in women who change pads in public toilets and waste-pickers who collect menstrual waste without protective gear. Already more than 4000 women trust PadCare.

- Environment: The next step was disposal. PadCare’s waste-management partners collect the waste and drop it at a Central Processing Unit. Through multi-step mechanics, the team breaks down absorbent sanitary waste, and recycles them into two by-products viz. cellulose and plastic. These can be used to make items such as packaging material, paver blocks, tables and pots. Thus the absorbents, that would otherwise be dumped in a landfill, are converted into useful products. PadCare has put more than 9500 pads to a better use so far, and reduced 5000+ kilograms of carbon emissions along the way!

- Technology: This is a real game changer. Ajinkya, being an engineer himself, always wanted to put his technology skills to use. His PadCare team uses advanced smokeless, silent chemo-mechanical processes and 5-D technology (Disintegration, Deodorisation, Decolourisation, Disinfection, Deactivation) to convert waste into final products. The icing on the cake is that the entire process costs less than 1/3rd of other recycling processes existing today…. true innovation indeed!

Achievements so far

PadCare Labs received seed funding in December 2020 under the Biotechnology Industry Research Assistance Council (BIRAC) in the category of Entrepreneurial Driven Affordable Products (LEAP) Fund. PadCare works with Toilet Board Coalition, Dassault Systems, TATA Trust, Unlimited India, CIIE, Pune International Center, and has received product development grants from government schemes such as NITI Aayog – Atal New India Innovation Challenge. It is backed by Infosys Foundation under “Aarohan” solving the unmet needs of Menstrual Hygiene.

Padcare is currently working with two prominent brands in sanitary napkin market for Menstrual Hygiene Management starting from awareness till sustainable disposal and has been awarded with ‘Most Innovative Start-up Award 2019’ by Government of Maharashtra and Nasscom.

Where does HSBC play a role?

While PadCare was doing commendable work, it was looking for a banking partner to help achieve its key objectives and provide support in –

- Regulatory compliance

- Setup of easy to use digital banking platform

- Facilitate seamless B2B and B2C digital payments and collections through UPI and other modes

- Innovative modes for expense management

- Provide guidance on global expansion.

To achieve this, PadCare commenced its journey with HSBC.

Says Ajinkya ‘HSBC is more than a bank for us. While it helps in ticking off all regulatory and operational boxes, it goes much beyond that. HSBC senior management has invested time in understanding the business of a 3-year-old start-up like us, and provided guidance on the way forward. This phenomenal customer experience has motivated us to work closely with HSBC, and we hope we achieve great things together’.

Says Prakash Jaiswal, Country Head, Business Banking (MSME, Start-ups), HSBC India, ‘For HSBC, it is not just about offering banking products- We want to go beyond banking, to help social enterprises bring a positive change in the society. PadCare is unique in this respect because of its dual objective of improving female hygiene and environment at the same time. We cherish our relationship with PadCare and look forward to working with them in the long term’

Packing a punch

A biscuit is one of the few items that everyone enjoys. However, have you ever wondered how a biscuit, manufactured thousands of kilometres away, stays crispy till it reaches the end consumer? Its packaging plays a significant role. If you look around your kitchen, you will find food in packets of all shapes and sizes. If we extrapolate, a few figures are quite intriguing. More than 17 lakh tonnes of packaging is utilised every year to pack food items manufactured by a single FMCG company. And our client Uma Convertor Limited has been in the thick of action in packaging, for last 22 years.

A steady performance over 2 decades

Uma Converter Limited is an Ahmedabad based company incorporated in 1999. The Company is engaged in business of manufacturing and export of flexible packaging material. It offers a wide range of customized packaging solutions for various industries such as food, beverages, pharmaceuticals and personal care among others.

Overcame a lot of obstacles on the way

In early 2000’s, Gujarat faced a number of natural and other crises. For a company like Uma Converter, it was a strong blow and sales dwindled. However, thanks to the firm’s tenacity and unwavering focus on quality, they continued to serve their customers. As a result of all these efforts, Uma Converter consistently enjoys a high level of loyalty among its customers.

Fast forward to today, Covid has spared no one. Uma has a large labour force. During lockdown, the firm took an unconventional route, and offered all medical and health facilities to its taskforce. On the business front, there was a sudden drop of sales from industries such as textiles & garments, agarbatti, mehendi cones, and many others. However, food industry compensated for this drop. Thanks to Uma’s strong relationship with its clients in FMCG and food manufacturing, it was able to increase its business by almost 3X from this industry.

How HSBC joined Uma's journey? The 10 PM rendezvous!

On 19th March 2020, Uma decided to explore financing from HSBC. Everything was all set to be executed like any other loan transaction. However national lockdown was declared on 23rd March. Mr. Sumer Lodha, MD of Uma Converters became a bit wary of availing loan facilities in this tricky situation. To add, visiting a bank branch to submit physical documents was impossible. However, HSBC team visited Mr Lodha’s premises at 10 pm in the night, and collected his physical signatures. Over the next few days, HSBC executed all documents digitally, and sanctioned the loan to Uma digitally.

This episode proved to be a great catalyst in the HSBC-Uma relationship

Says Mr Lodha ‘We generally perceive MNC bankers as corporates adhering to strict guidelines and timelines. It was refreshing to note HSBC’s informal way of banking, especially during crisis. They didn’t hesitate to travel in tough times, and visited us, even though it was very late in the evening. The team simplified the processes, and sanctioned our working capital in a short span of time. Thanks to HSBC, we were able to launch a new vertical, contributing to our expansion plans. HSBC’s polite way of dealing with SMEs like us helps us feel very special. Looking forward to working with HSBC closely in the future’

Says, Prakash Jaiswal, Country Head, Business Banking (MSME, Start-ups), HSBC India, ‘We don’t notice it, but all of us are indirectly Uma Converter’s clients! We consume their products daily. Their work, especially during lockdown is inspiring. Hence supporting them by going out of the way was critical for us. As far as SME financing is concerned, banks can no longer have a cookie cutter approach. We, at HSBC will continue to work with firms of all sizes, understand their business better, and offer best solutions. We hope to continue to work with Uma Converter in their journey’.

What strikes you first when you are evaluating products from multiple companies? Their visual appeal. This is especially true in personal care and food products, wherein we subconsciously give more attention to packaging than ingredients. For more than 35 years, our client Arun Plasto has been working tirelessly to help brands appeal to our visual senses.

It all started with a mother’s advice…

In 1984, Mr. Marimuthu’s life was perfect. A fresh graduate, he was set to join a reputed engineering firm and earn 3X the salary of his teachers. However, his mother had different plans for him. She persuaded him to start a business and bring a positive difference to the society. It was an unconventional route for a graduate in those days.

Marimuthu took the plunge, and rest, as they say, was history!

Today, his firm Arun Plasto is a reputed name in areas such as FMCG packaging, food packaging, plastic ancillary equipment, electronics, agriculture and horticulture and polycarbonate sheets. Name any item – disposable water glass, ice cream cup, meal tray, spoon, food container, soap bar container, pots, etc, Arun Plasto has them all covered. Equipped with 8 plants across the country and latest technology, Arun Plasto boasts of clientele across leading Indian and global MNC firms.

It’s a truly inspirational story of building a company from ground zero.

An ambition to catapult, and a boost from HSBC

Whenever FMCG companies want to enhance or launch a new product line, they entrust their partners with a project. The project manufactures components needed for that particular product launch. Arun Plasto was very keen to take one such project. However, there was an issue. The project required an upfront capex investment of INR 30 crores, which was a bit challenging for Arun Plasto to arrange. Mr. Marimuthu was also a bit skeptical of approaching banks. He had managed the company for 30 years without bank’s finance, and had a few not-so-great experiences in the past.

However, it all changed post his meeting with HSBC. HSBC’s top leadership met Mr. Marimuthu. They understood Arun Plasto’s business, its ambitions, and extended capex financing on favourable terms. Mr. Marimuthu was able to accept the project and execute it.

This propelled Arun Plasto on a higher growth trajectory. Since then, Arun Plasto has undertaken many ambitious projects, each requiring large capex investments. HSBC has participated in multiple rounds of capex financing, and will continue to support Arun Plasto’s ambitions.

Says. Mr. Marimuthu, ‘In the past, financing was proving to be an issue for us in executing large projects at scale. HSBC has changed everything for us. It was very refreshing to receive personal care from senior management at HSBC. We now have the confidence to dream big, and are even able to upfront propose many such projects to our clients in India and abroad. We thank HSBC, and look forward to working with them in the long run’

Says Prakash Jaiswal, Country Head, Business Banking (SME and Start-ups), ‘Gone are the days when banks played a reactive role. Banks can no longer act as a vanilla lender with a cookie cutter approach towards borrower due diligence. Today clients expect banks to play a more proactive role and act as a partner. HSBC works with its clients from early stages and provides customised financing solutions at each stage of their journey. We cherish our relationship with clients such as Arun Plasto and look forward to help them scale rapidly.

India is in a high growth phase, and SMEs have laid out ambitious plans. We at HSBC are keen to become your trusted partner and provide necessary services ranging from lending, transaction banking, cross-border trade finance, international expansion, regulatory guidance, digital banking and many more. We would be keen to understand your needs and work along with you.

Education has always held paramount position in the Indian society. Many of our historical stories begin with princes going to Gurukuls, living the hard life to imbibe knowledge across disciplines to become great kings. Over time, education democratised. However high quality education still remains largely out of reach for the common man.

People have now realised that a hybrid, tech-integrated model of schooling is where a more equitable future lies. Interestingly, that’s a realization that our client UOLO had way before COVID and, instituted an innovative solution that placed them ahead of the curve.

Develop in Style

After spending years in Silicon-valley, and understanding the ever evolving landscape of modern tech, Ankur and Pallav realized that education in India is yet to experience the fruits of technology.

At Uolo, they focus on providing world class experience to students and teachers by offering a mini ERP & Learning Management System (LMS) to schools, mostly in Tier-2, Tier-3 cities. Their platform has an added security feature to facilitate seamless flow of education, differentiating them from all other generic video conferencing solutions. To enhance the learning experience, their product ‘After School hours’ takes care of all extra-curricular needs of students. To keep the spirits high, their ‘Speaker series’ provides the students an opportunity to hear from accomplished personalities. All this leads to a superior learning experience, historically available to a select few. To top it all, their offerings are available at 0 cost. 5000+ schools have benefited out of this, and counting.

Creating Capacity for Growth

To revolutionize a sector that has every Indian emotionally invested, UOLO needed a partner with their heart in the right place. That’s when a chance meeting with HSBC led to the start of a relationship with HSBC India. It was followed by opening of accounts for their parent in Singapore. When UOLO received 2 rounds of funding, they decided to invest these funds with HSBC. Once their operations began, UOLO started using HSBC’s one-of-the best in class digital platform, HSBCnet, to make vendor payments on the fly.

Ankur and Pallav say, “What makes it exciting to start-up in India is the unique set of challenges and opportunities the country offers. Add to that a solution in education, which is our country’s number 1 priority and a household talking point. There is no scope to compromise. Fortunately, we found in HSBC a partner that takes care of our banking needs with the same zeal that we employ in our business operations.”

Sanchit, VP- Finance, UOLO, adds “HSBC, in addition to having a start-up’s intensity in their servicing also has the technological infrastructure and regulatory know-how to support all complex transactions. It gives us immense confidence that they already have solutions for all our future needs.”

Says Prakash Jaiswal, MD & Country Head, Business Banking (Start-ups and MSMEs), “It is fascinating to see how a new age company is on track to solve the education puzzle, which was largely accepted as a systemic quagmire. UOLO has all the technological & ethical wherewithal to revolutionize the next billion segment. I see HSBC Uolo collaboration scaling great heights and achieving milestones like none other.”

Start-ups’ requirements for banking services are very different from that of conventional businesses. HSBC has carved out a dedicated team to support start-ups, and created a bouquet of unique products and solutions.

If you need a banking partner that will help you grow, we would be happy to discuss synergies with you.

We take many things for granted, especially those that are perceived as free. The best example is of water. On one hand millions of people across the world have no access to adequate safe drinking water, on the other hand, hundreds of thousands of litres get wasted every minute in the very same world…

While many of us only talk about the problem, 4 people from Chennai decided to do something about it. They founded WEGoT in 2015, and it has been nothing short of a miracle since then.

Want freedom from water woes? WEGoT you covered

WEGoT stands for Water, Electricity, Gas of Things. They are driven by the mission to create a world with enough resources for everyone. To achieve this, they want to use technology and data to bring a behavioural change towards natural resources consumption.

WEGoT developed an innovative IoT ultrasonic device- Aqua. It measures water usage on a continuous basis, detects leakages, and notifies the user on a mobile app. Their devices are easy to install, rain proof, and boast of an accuracy of 99.9%. Today WEGoT devices have been installed in residential areas, commercial establishments such as IT parks, hotels and industrial units.

Their efforts have made their consumers water conscious and many are self-governing to tide over problems with water supply. They are also now able pay only for what they consume. Read success stories here

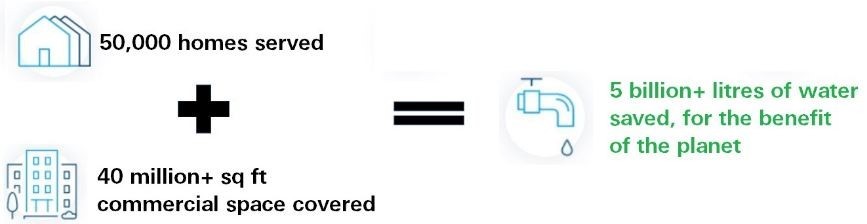

So, what impact has WeGOT created so far?

Innovation meets innovation...

Customers across geographies are demanding WEGoT's solutions. WEGoT sources spare parts from local manufacturers and also imports them from other countries.

To meet domestic and global demand and supply, WEGoT wanted to work with a bank that has strong presence in India and other markets. They turned to HSBC.

HSBC provided them with access to HSBCnet which enabled the WEGoT team to track all their balances, and manage domestic and global transactions at one place in real time.

To ensure financing doesn't come in the way of smooth supply, HSBC helped the WEGoT team with LAI (Loan Against Import) facility.

To further simplify operations, HSBC has provided corporate credit card to WEGoT. Additionally, as part of HSBC's Beyond Banking, WEGoT's HSBC and Zoho Books accounts are seamlessly integrated. WEGoT can execute multiple third-party payments from the Zoho platform and get the status in real time.

These innovations have paved the way for WEGoT to achieve its mission at a global scale, and there is more exciting stuff on the way.

‘Our goal is to bring a positive difference in the society, and we were eager to work with a partner that thinks like us. We found a perfect match in HSBC. Their approach of serving start-ups like ours is truly distinct, and we no longer need to worry about any activity behind the scenes. Their Beyond Banking offerings are quite unique, and will truly take care of all our needs. We look forward to working with HSBC as we continue in our mission to conserve the earth's natural resources' - WEGoT founders- Abhilash Haridass and Mohammed Mohideen

Says Prakash Jaiswal, MD & Country Head- Business Banking (Start-ups and MSMEs), ‘Sustainability is an important objective for us, and we take immense pride in serving start-ups who apply technology to solve real world problems. WEGoT is doing extremely inspirational work. As they continue to serve the world at large, we look forward to provide all the support'

To meet all of start-ups' needs, HSBC has carved out a dedicated start-up banking team, and created a bouquet of unique products and solutions. If you need a banking partner that will help you grow, we would be happy discuss synergies with you.

“A ship in a port is safe, but that’s not what ships are built for.”

This quote rightly indicates how important it is for a ship to sail. There is more to a ship than fancy parties. It requires more than we can imagine on board to make a smooth sail— While we enjoy cruises, ever wondered how are operations of the crew managed? Shipskart made it their goal to improve the supply chain and building an e-commerce solution to reduce the hassles at shore.

The sail of our Captains and making of Shipskart:

Dhruv (CEO & Co- Founder, Shipskart), a passionate maritime leader is focused on employing great technology to achieve innovation and scalability in the marine logistics. He believes, “No matter how great or tiny, a dream leads to invention and innovation.”

Being a Master Mariner (Captain) in the Merchant Navy and Oil & Gas Industry, Dhruv felt the pain of the cumbersome procurement processes onboard, be it something as simple as stationary to something of daily necessity such as Provisions (FMCG). This motivated him to start Shipskart along with his co-founders Vivek Sahi a fellow Mariner and Sunny Bagla, a childhood friend.

Shipskart is a supply chain e-commerce solution for the maritime and offshore industries, founded in 2017. An online marketplace where boats, vessel owners, operators, and managers acquire marine items, consumables, equipment, and service products essential. Shipskart has offices in India, the Netherlands, and Dubai and presently serves over 100 ports worldwide. From food to Spare parts, medicines to stationary they have 33+ categories covered to make the sail smooth.

This journey of starting with small capitals to pooling handsome capital was not without hurdles. But belief to make efficient maritime logistics chain with a revolutionary vision made it worthy. They went on to shine the route and are one of world’s leading supply chain and logistics e-commerce solution in the maritime space. There customers have immensely benefitted with reduced supply chain hassles at shore. It was indeed, a great sail!

Efficiency offshore as well

To support their rapidly progressing voyage, Shipskart felt the need for a banking partner that will take case of all needs back home.

To commence, Shipskart needed to set up a new company in Singapore for smooth operations and fund raise. However, it was facing an issue with existing bankers. Each of them quoted a very high turnaround time that was unfit for the pace at which Shipskart was operating. That’s when HSBC came into the picture. With our robust International Business Banking proposition and MNC presence, Shipskart was able to open a new account in just few days. Further, Shipskart started using HSBCNet, an award winning global platform for its international payments and domestic collections, HSBC has also been facilitating Shipskart’s funding related requirements, capitalizing on its regulatory and market related expertise garnered over 150+ years of presence in India.

To take things ahead within business operations, Shipskart opened salary accounts of their growing employee base with HSBC. Founders' appreciation motivates us to push more...

Says Dhruv, “We aim at growing our business by several times in the coming year, this makes us seek for a consistent and efficient banking partner. HSBC has helped us drive this business across multiple themes, and reduced the process time it generally takes in a bank while streamlining banking for us and our employees.”

Prakash Jaiswal, MD, and Country Head of Business Banking (MSME and start-ups), says, “At HSBC we truly believe in giving wings, well sails in this case, to a founder’s dream. Our client Shipskart has played a prime role in transforming the journey of maritime supply chain and logistics. We are thrilled to have played a role in their success. We look forward to proceeding to leverage our strengths to assist them scale up.”

After our family, our own home occupies the highest place in our lives. Naturally, each of us tries to give our homes the best look possible, and Livspace is among our top choices to make it happen.

Making our homes special

Livspace needs no introduction. It is a technology based marketplace that acts as a one-stop shop for interior design and renovation of our dream home. Be it our living room, kitchen, bedroom, wardrobe, kids’ room, guest room, or bathroom, Livspace and its specialised team of designers ensure we always get the best. Livspace uses a combination of data science, algorithms, and industrial designs, enabling us to discover a variety of interior designs for all types of rooms, and personalize it further basis our individual preferences.

From a business perspective, Livspace is headquartered in Singapore with a presence across India, Malaysia, KSA. The company turned Unicorn this year and has ambitious growth plans. In India, Livspace has presence in over 30+ cities, with 25k+ home projects delivered successfully. They have around 1000+ design partners on-board their platform, 100+ Product vendors and multiple manufacturing partners, and growing.

Best Banking for best designs

Livspace assesses the unique needs of each room, crafts personalised solutions for each, and ultimately delivers a complete package for our home. It expects its banking partner to deliver a similar experience; by catering to local needs of its operations in each country, while complementing its global structure. HSBC with its global network in 60+ countries fits the bill perfectly. HSBC has a full-fledged International Banking practice, and is bringing the best to Livspace.

Livspace banks with HSBC in 4 countries: Singapore, India, Saudi Arabia, and Malaysia. It uses HSBCnet, HSBC's global award winning internet banking platform wherein it can manage all global banking and transaction processing related requirements at a single place

Further, to meet their local and global expansion plans, Livspace is utilising multiple facilities from HSBC’s suite of banking products.

Going Beyond Banking: HSBC cherishes client relationships beyond day-to-day banking. On 8th September 2022, HSBC’s Global Group CEO Mr. Noel Quinn met Ramakant Sharma, Co- Founder and COO, Livspace among other founders to discuss how new age firms are contributing to the success story of the country. Click here to know more.

Says Saurabh Agarwal, CFO, Livspace, “Livspace's vision is to be the world's largest omnichannel home interiors and renovation platform. HSBC has played a great role in our journey so far. Apart from its world-class solutions catering to all our business needs, what really stands out is their human touch. They deeply understand our business and growth plans, and always offer the best services. We cherish our relationship and look forward to working with HSBC in the future.”

Says Prakash Jaiswal, MD & Country Head, Business Banking (MSME and Start-ups), “We spend a significant time of our lives in our homes, and Livspace is ensuring it’s a worthy experience for all. HSBC measures its success by the success of our clients, and we take pride in all domestic and global requirements of valued customers such as Livspace, and exceeding their expectations.”

The Indian business landscape is a unique puzzle. From your local mom and pop store to the un-missable ‘Halwai’ shop across the street, a beautiful entanglement of business with community is evident everywhere. While this cultural highlight makes us stand out in the offline space, our companies often struggle to scale beyond a point in the online world.

Managing essentials of an e-commerce venture like tracking inventories, performance marketing, on platform merchandising, catalouging, product development and so on, without the feedback mechanism of a traditional business, can prove to be a herculean challenge. Well, if you’re an entrepreneur stuck in this dreaded situation, Fret not Thyself!

Evenflow rescues businesses from this situation by acquiring and scaling e-comm led businesses.

Connecting the dots looking backwards

Utsav (CEO & Co-Founder, Evenflow), in his own life, went from building and running a small passion project to overseeing international expansion at a hyper-growth start-up and then using his learnings to replicate the success at yet another venture. Essentially, in a span of 10 years, he lived through the entire magical journey that Evenflow has in store for its promising acquirees.

Coincidentally, it was around the same time that he came across the e-commerce aggregator model and Evenflow was born. With a dedicated team of experts from supply chain to marketing, the vision is to transform indigenous dhandas into globally renowned brands.

Fair evaluation, Focused acquisitions & Freedom of choice

Evenflow achieves a maximization of growth and acquiree satisfaction by ensuring an unwavering focus on high quality e-commerce brands & meticulously customized terms of acquisition.

Their Recent Acquisitions show the breadth & depth of this young enterprise.

360° financial support system for our growth enablers

Raising funds is a significant step in a start-up’s journey and it was at that point that they crossed paths with HSBC, when the bank’s FDI regulatory expertise helped them get through the arduous path seamlessly.

To streamline finances of Evenflow’s brands, HSBC provided them with a single sign on to its award winning offering, HSBCNet. It enables operations and tracking of all their associate entries on a unified platform. Cherry on the cake is the integration with ZOHO under the Beyond Banking proposition, to facilitate third party payments at the click of a button.

Utsav & Pulkit - Co-founders, Evenflow

“For a tech enabled conglomerate of sellers, growth necessitates a truly digital infrastructure, backing day to day operations. To deliver on our promise of transforming businesses to globally recognised brands, we always needed a tech-minded banking partner. It is a testament to HSBC’s solution centric approach that we trust them with the entire wallet responsibility of Evenflow + all associated entities.”Says Prakash Jaiswal, MD & Country Head, Business Banking (MSME and start-ups), “We at HSBC take great pride in our widely regarded product offerings. Evenflow’s success story encourages us to solidify our resolve to keep innovating and constantly thinking from a founder’s perspective. We take full responsibility for providing them with all the banking support needed to achieve their dreams and beyond.”

When was the last time we paid serious attention to AQI (Air Quality Index)? While you’re thinking, here’s a shocking fact – In 2019, ~2.3m Indians succumbed to air pollution (source). In addition, between 50-65% of chronic lung diseases are estimated as attributable to air pollution.

This is a major issue globally and cut-paste solutions from developed nations are too expensive and ill-suited for mass local adoption. The recent news of electric vehicles catching fire was just one example of this phenomenon.

To address this, our customer Altigreen Propulsion Labs resolved to venture into carbon free commercial last mile transportation with a two-fold vision:

- Manufacturing EV technology For and By India

- Outperforming combustion engines

Origin story

Amitabh, Shalendra, John & Lasse would often find themselves debating the issue of burgeoning carbon footprint in India. After a point, the pull became so strong that despite having no EV experience they decided to take the plunge.